|

FTB is BROKEN ♦ INTRODUCTION ♦ ATTORNEY VIOLATES TAX CODE REPEATEDLY - FTB DOES NOTHING ♦ FTB AIDS & ABETS TAX EVASION ♦ WHY IS CALIFORNIA THE "VOLUNTARY" TAX STATE? ♦ FTB'S MISSION, PRINCIPLES AND VALUES ♦ ABOUT ME & ZF MICRO SOLUTIONS ♦ CONTACT ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ § ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶

I am an entrepreneur who has founded several companies in California. Those companies paid California taxes and employed hundreds of people in California who also paid California taxes. That makes it all the more galling that the California Franchise Tax Board has chosen to turn its back on the companies and individuals who reside in this state and instead aid and abet the tax evasion of out of state agencies who operated here under the radar for decades but never contributed a dime of taxes to support any of the benefits they enjoyed here. This website is the product of twelve years of frustration I have experienced in a futile attempt to persuade the Franchise Tax Board (FTB) to enforce California tax laws and protect the honest taxpaying citizens and California Courts from tax evaders. Legislators

can 1. If our representatives want legislation regarding taxation to be enforced, they must revise the Revenue & Taxation Code to eliminate instances of the word “may” relating to what action the FTB takes in specific cases. "May" must be replaced by “shall.” The FTB appears to interpret the word “may” as license to selectively choose when to enforce the law or, even worse, as justification to do nothing.

2. The

tax code must indicate the time frame within

which action by the FTB must occur.

I first discovered SANDS did not register with the Secretary

of State on 7/18/2007. I reported this to the Court.

SANDS registered with the Secretary of State a few days later (8/3/2007) but

failed to mention they began operating in California in

1999. I reported this to the FTB in August of 2007 (one of many

reports the FTB has ignored). I told the FTB I was a witness to SANDS'

illegal operation in California since 1999 and gave them proof. Over the next several

years I sent additional information about SANDS’ illegal

California operations (including proof of a payment to SANDS by our company). From the

time SANDS first registered until today, they have never filed

California tax returns or paid taxes here as shown in the

Certified

Response by FTB to my Public Records Act request. It took the FTB until November of 2013 to

forfeit SANDS.

(FTB

definition of Forfeited: "The business entity was

suspended or forfeited by the Franchise Tax Board for failure to

meet tax requirements (e.g., failure to file a return, pay taxes,

penalties, interest.) 3. The tax code must include a directive to the Courts that requires them to compel every litigant in a civil case to provide the Court with certified FTB proof that the individual or business entity has filed tax returns, paid all taxes due, and is in good standing as of the most current year, and during every twelve months that a case remains pending in the Courts. This would rely on item 2 above being enacted, because in the case of the SANDS entities, who registered but never filed tax returns or paid taxes, the FTB did nothing for six plus years. The result was that SANDS' status with the Secretary of State indicated SANDS was “active.” SANDS used this to repeatedly mislead the Courts by stating that they were in good standing. SANDS only appeared to have “standing” because the FTB was “sitting” on their knowledge of SANDS' delinquency and never took action. ̶̶̶ ̶̶̶ ̶̶̶̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ § ̶̶̶ ̶̶̶ ̶̶̶̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ Enforce, Ignore or Punitive Audit? It will be interesting to see whether this website persuades the FTB to enforce the law. I will not hold my breath. The FTB may just continue to ignore the evidence and the law and do nothing. Or, perhaps they will decide to make an example of anyone who has the audacity to expose their contempt for their "Mission, Principles and Values." Stay tuned! The failure of the FTB to protect the State’s revenue affects every other aspect of California’s government and is a driver of California’s on again off again fiscal problems. The FTB’s unwillingness to enforce the law is compounded by unethical attorneys who, aware of the FTB’s apathy regarding tax evasion, intentionally deceive California courts and flout the tax laws enacted to prevent tax evaders from transacting or attempting to transact intrastate business in this state on behalf of a foreign corporation, the rights and privileges of which have been forfeited. These attorneys fear no negative consequences when they undermine the courts and the will of the people. To prevent illegal use of the Courts by tax cheats, the legislature passed specific sections of the Revenue & Taxation Code to prevent tax cheats from using California courts but the FTB’s failure to enforce the law creates a situation where the tax cheats have the upper hand on every honest business and individual in California. Although the FTB is by far the worst of the agencies I have dealt with, there are many other agencies and non-governmental entities, such as the State Bar of California, that also refuse to act because the unethical attorneys deceptively claim that their clients have done nothing wrong, and they are supported by the FTB’s lack of prosecution. If you expect the FTB to pay any attention to you or enforce the law you'll have to wait until...

̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ § ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶ ATTORNEY VIOLATES TAX CODE REPEATEDLY - FTB DOES NOTHING California attorney Michael B. Carroll has repeatedly appeared in court and filed pleadings on behalf of Sands Brothers Venture Capital LLC (CA tax ID ) and SB New Paradigm Associates LLC (CA tax ID ) [hereafter together as “SANDS”], his clients who have been forfeited by the State of California for failure to file tax returns or pay taxes. The filings and appearances are violations of Revenue & Taxation Code (R&TC § 19719(a), a misdemeanor, and R&TC § 19705 sub. (a)(2) and sub. (d), a felony). Does the FTB do anything? NO! THERE IS NO GRAY AREA HERE. There is nothing for the FTB to investigate or determine. Attorney Carroll's violations of the law are documented by the transcripts and pleadings that are part of the court record. It does not take a legal scholar to know that, as an officer of the court, an attorney who misstates the law, as attorney Carroll did, is intentionally deceiving the court. It is also clear that his deceit was done with malice aforethought because he knew when he entered the court that his clients were forfeited and by representing them he was aiding and abetting his clients' tax evasion. R&TC § 19719(a) and R&TC § 19705 sub. (a)(2) and sub. (d) are unequivocal black letter law that is not subject to interpretation – especially by the person violating them. I reported the tax evasion to the FTB and told them I was a percipient witness with additional evidence who would testify in a criminal proceeding. Has the FTB responded to my complaint? NO! Has the FTB even had the courtesy to respond? NO! WHY NOT? The FTB hides behind R&TC § 19542; R&TC § 19542.1; R&TC § 19542.3, claiming they are prohibited from releasing a taxpayer’s “confidential information regarding furnished or secured pursuant to this part, Part 10 (commencing with Section 17001), or Part 11 (commencing with Section 23001).” This is just an excuse to cover their dereliction of duty to prosecute tax evasion. FTB investigators claim they cannot speak with a percipient witness to a crime because they are required to protect the privacy of a tax evader? What? Are they insane? Imagine if the police told victims and/or witnesses to crimes that they could not speak with them in order to protect the privacy of the assailant! Any other law enforcement agency would be ridiculed and considered incompetent or derelict. Aside from the absurd “logic” behind their refusal to speak with a percipient witness to multiple instances of tax evasion, I am not asking to see any confidential information that the SANDS entities submitted to the FTB. In fact, SANDS were forfeited by the FTB because they have never filed a return or paid any taxes, so the FTB has nothing from SANDS that they could show me – even if they wanted to! I am offering to provide additional evidence documenting 19 years of tax evasion by SANDS in California but the FTB is not interested. I have proof of SANDS’ transacting intrastate business in California beginning in late 1999 and continuing (through the illegal representation in California courts) to the present. I have proof of payments SANDS received related to their California intrastate business transactions totaling millions of dollars. No thanks, not interested! I have also attempted to point out to the FTB that since SANDS have never filed a tax return or paid a dime in California taxes, they can hardly be referred to as taxpayer entities whose “privacy” is protected pursuant to either R&TC § 19542, R&TC § 19542.1, or R&TC § 19542.3. Additionally, I have been reminding the FTB that their own publication, FTB Publication FTB 689 (REV 09-2011) and the latest version FTB 689 (REV 03-2019) both specifically state: “In addition, privacy laws do not protect fraudulent activities.” [It is noteworthy that this form used to be on the FTB website "forms" page but now you have to know it exists and file an e-mail request to obtain it. It must be that pesky clause about "privacy" not protecting fraud!] I have offered to indemnify (up to the full potential $5,000 fine) any FTB employee accused of “revealing” any private information referred to in R&TC § 19542, et seq. No thanks, not interested! I expect attorney Carroll to again appear illegally and participate, on behalf of his forfeited clients, in oral argument in an appeal pending before the Sixth District Court of Appeal, so I offered to defray the costs for an FTB investigator to attend the hearing in San Jose to witness the crime firsthand. No thanks, not interested! You may think it would make sense to also file a complaint against this attorney with the State Bar of California. I did. The State Bar cares even less about attorney's who violate rules and law than the FTB. That’s another story for another web site (coming soon: Regulate-Lawyers.com). Read the Complaint ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ § ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶ You can lead the FTB to the law, but you can’t make them enforce it. When the FTB picks and chooses which laws it will enforce and which crimes to prosecute it is violating its stated Mission, Principles and Values (see below) and undermining the will of the people of California as enacted by their elected representatives. The refusal to enforce the law against this attorney and his clients cannot be because it is not worth the effort, as the amount of taxes, interest and penalties for the years 1999 through 2019 is in the hundreds of thousands of dollars. The total due may be far in excess of that amount if the FTB looked into SANDS’ other California activities aside from those which I reported. According to the FTB’s Interagency Intercept Collection Program Participation Guide for 2020, the minimum amount the FTB will attempt to collect is $10.00 (see Chapter 2, Debt Criteria). Perhaps the real reason the FTB does not prosecute the SANDS entities and their attorney is that doing so would actually require work on their part. It is much easier to send a threatening letter to a low-income individual to collect $10.00 knowing that the threat of garnishing their wages alone will prompt compliance. As long as the bureaucrats at the FTB are the ones running the asylum with little or no oversight the Mission, Principles and Values will all fall by the wayside. On numerous occasions over the course of 12 years, I have sent the FTB hundreds of pages of evidence confirming that the SANDS entities were doing business and transacting intrastate business in California, and had nexus through their San Francisco office and California and New York employees. During the litigation that SANDS began in February of 2005, we discovered (July 2007) that the SANDS entities had never registered with the California Secretary of State. However, their verified complaint, filed under penalty of perjury, stated they were “duly authorized to conduct business in the State of California.” Revenue and Taxation Code § 23301.6, defines duly authorized unequivocally: “A taxpayer that is required under Section 2105 of the Corporations Code to qualify to do business shall not be deemed to have qualified to do business for purposes of this article unless the taxpayer has in fact qualified with the Secretary of State.” (It would seem that perjury is no longer a crime in California.) When we notified the court that SANDS was not registered, SANDS registered on August 3, 2007, after the statute of limitations had already run on SANDS purported claims. Although SANDS has never paid a dime in California taxes it took the Franchise Tax Board until November of 2013 to finally forfeit them for non-filing of returns or payment of taxes. Now even though their attorney continues to appear illegally on SANDS’ behalf, the FTB looks the other way. When the FTB refuses to investigate and/or prosecute tax evaders, any rational observer would consider them to be complicit in the commission of the crime. In essence, the FTB is aiding and abetting tax evasion. What is the FTB’s mens rea, or state of mind, when they refuse to speak to a percipient witness to the crime of tax evasion? According to the Model Penal Code there is a four-tiered classification of the mens rea related to an illegal act. Of the four classifications, the FTB’s failure to act against intentional tax evasion qualifies under the first three.

1.

acting purposely - the defendant had an underlying conscious

object to act

2.

acting knowingly - the defendant is practically certain that the

conduct will cause a particular result

3.

acting recklessly - The defendant consciously disregarded a

substantial and unjustified risk

4.

acting negligently - The defendant was not aware of the risk but

should have been aware of the risk Unfortunately, the FTB has been granted immunity by the legislature (presumably after heavy FTB lobbying efforts) that allows them to pick and choose who they will prosecute. As far as I can tell, no guidelines exist (or if they exist the FTB will not produce them) regarding the criteria upon which their decisions are based. If you or I ignore the law, and in doing so we commit a crime, and percipient witnesses identify us, we will most likely be prosecuted. The FTB will make an example of a defenseless low-income individual who can’t fight back but will stand on the sidelines as those with resources or political influence get away with tax evasion that rises to the level of grand theft. The FTB allows dishonest attorneys to lie to the courts and abuse the system they should not have access to because it would require actual work to challenge their false claims. It apparently does not matter to the FTB that they become accessories to tax evasion or that honest taxpayers’ life savings are stolen by criminals using the courts illegally. It is time to take “enforcement” out of the hands of an agency that refuses to act in the interests of the people of California. This agency has an annual budget of almost a billion dollars per year, yet it has a collection record that places it far below any private debt collection company average. ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ § ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ WHY IS CALIFORNIA THE "VOLUNTARY" TAX STATE?

The law must be changed so that tax cheats are denied the services the rest of us pay for and support. No state agency should be allowed to issue use permits, licenses, certificates to any business that is not current in all registrations and tax payments. A simple mandate that any business entity present a certificate from the Secretary of State and the Franchise Tax Board that all required filings are current and that all fees and tax payments are up to date before they are allowed to file a lawsuit or defend an action in California courts based on any business transacted in California. ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ § ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ FTB'S MISSION, PRINCIPLES AND VALUES Read their lofty statement here> About the FTB

A Bit More About "Transparency" In a time when we are demanding more transparency from our government agencies, the FTB strives for less. Prior to 2012, when you asked the FTB to provide the status of an entity, the FTB gave you a document that contained much more information. Then the FTB announced taxpayers could save time and money (their time or ours?) using the FTB’s new online self-service application for obtaining entity status letters. The problem is, the FTB now provides far less information than they did previously. Entity Status Letter Before 2012 Entity Status Letter After 2012

Why the change? Could it be that they were embarrassed by their failure to actually provide all the information on the previous form? Or perhaps they wanted to cut a few positions so there is more discretionary budget money for… well we don’t know what they really do with a budget of almost a Billion dollars. They certainly are not using it to close the tax gap or enforce the law regarding tax evaders and their attorney co-conspirators. Perhaps if the FTB showed a bit more interest in enforcing the law the state’s tax gap would not be growing at the astonishing rate that it has. The 2006 report on the Tax Gap by then Controller, Steve Westly, showed the gap was $6.5-Billion. Then, in the 2011 Annual Report to the Legislature, submitted by Executive Officer Selvi Stanislaus, the tax gap was listed as approximately $8.5-Billion. Just eight years later, the FTB proudly reported that for 2018, the estimated annual tax gap for California is $20 billion to $25 billion! On the linked page, the FTB states that “One of our main responsibilities is to collect state income tax and corporate franchise tax. Sometimes, people don’t pay their taxes. Those who don’t pay their state income taxes contribute to California’s tax gap — the difference between taxes owed and taxes paid.” This same page also lists the top 500 tax delinquencies. The Corporate income tax list of Top 500 tax delinquencies totals $29,480,832.59 and the Personal income tax list of the Top 500 tax delinquencies totals $556,957,276.82. Even by government standards that’s money worth going after. If the FTB won’t do it I am certain that a reasonable collection fee would encourage freelance attorneys to take up the cause. Wasting thousands of dollars in time and effort, the FTB goes after someone in their 70s who owes $392 while leaving more than half a billion on the table! Here’s a thought: Start prosecuting the tax cheats and publicize the prosecutions. The number of scofflaws who decide to pay voluntarily might increase significantly! If you decide to try this and need an easy to prosecute test case complete with documentation and percipient witnesses go back up to ATTORNEY VIOLATES TAX CODE REPEATEDLY - FTB DOES NOTHING. ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ § ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶

In February of 2002, I founded ZF Micro Solutions, Inc. It was a company intended to carry on the vision I had developed over the previous 20-plus years vision to continually reduce the size and power consumption of embedded computing devices by making very low power, high reliability, cost-effective computing devices suitable to be embedded in all manner of Original Equipment Manufacturers (OEMs) products. It all began with an idea I had in 1982 to design a small low-cost single-board computer that could be mounted directly to a disk drive. I decided to start a company to market it in 1983. I quit my job and started Ampro Computers, and I invited an engineer and a programmer to join me. Ampro Computers, Inc., developed small form factor single board computers for the OEM market. In 1983, I designed our first processor board to be the same footprint as the then popular 5.25-inch disk drives. Next came a board that approximated the size of next generation 3.5-inch drives and that ultimately became the PC/104 industry standard.

It was at that point that the company that was manufacturing the ZFx86 saw an opening and it decided to misappropriate the technology and sell it directly to the customers we had developed. That led to a two-and-a-half-year legal dispute. It ended with a settlement that returned the ZFx86 technology to ZF Micro Solutions along with a $20-million cash settlement and tens of millions of dollars in intellectual property licenses. Just days after ZF Micro Solutions received the settlement in 2005, TAT, the VC firm that had thwarted ZF Micro Devices funding efforts and caused its demise, joined with two other VC firms that had invested in ZF Micro Devices, and filed a lawsuit against ZF Micro Solutions claiming they were entitled to receive a portion of the settlement despite the fact that they had never invested in ZF Micro Solutions. The VC’s who joined TAT were two related New York-based VC firms, Sands Brothers Venture Capital LLC and SB New Paradigm Associates LLC (“SANDS”). On July 18, 2007, I discovered that neither TAT nor SANDS had ever registered with the California Secretary of State even though they had been operating from their offices in California since 1997 (TAT) and 1999 (SANDS). This is significant because TAT and SANDS original complaint, was verified by TAT’s founding California officer, Mark Putney. The February 14, 2005, TAT and SANDS verified complaint, signed by Mark Putney, under penalty of perjury, contained a number of false statements; at pg. 1, lines 24-27: TAT states it is a Netherlands Antilles Limited Partnership, but it is actually a Swiss corporation. TAT forgot to mention this until late in 2009 when they changed their story in order to try to avoid being sued as a partnership. TAT has never been "duly authorized to conduct business in the State of California" because they never registered with the California Secretary of State which is required by R&TC § 23301.6 if a company claims it is “duly authorized.” TAT had the required nexus with California to be required to register with the Secretary of State because it maintained an office and paid employee in California, confirmed by TAT’s verified statement that its “main office in the United States is located in the City of San Jose, County of Santa Clara.” Then at pg. 2, lines 1-3 it states that SANDS is also "duly authorized to conduct business in the State of California" but since it had not registered with the Secretary of State, that was also false. Finally, on pg. 12, Mark Putney declares that he is a party to the action (which he later denied in order to avoid being sued personally), that he read the complaint and knows the facts to be true and he declared “under penalty of perjury” that “the foregoing is true and correct.” Unless out of state entities transacting intrastate business in California register with the Secretary of State and file tax returns and pay taxes, they are not permitted to use California courts and may not be represented by attorneys in the courts. This began my twelve-year battle to have the Franchise Tax Board enforce the law and prosecute these tax evaders who have destroyed a company, ruined many individuals lives, and made away with millions – all tax free! ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ § ̶̶̶ ̶̶̶ ̶̶̶ ̶ ̶̶̶ ̶̶̶ ̶̶̶ ̶ Have a question or comment? Contact me at: Subject line: FTB is Broken |

|

|

♦ INTRODUCTION ♦ ATTORNEY VIOLATES TAX CODE REPEATEDLY - FTB DOES NOTHING ♦ FTB AIDS & ABETS TAX EVASION ♦ WHY IS CALIFORNIA THE "VOLUNTARY" TAX STATE? ♦ FTB'S MISSION, PRINCIPLES AND VALUES ♦ ABOUT ME & ZF MICRO SOLUTIONS ♦ CONTACT |

David Feldman, Founder and CEO, ZF Micro Solutions,

Inc.

David Feldman, Founder and CEO, ZF Micro Solutions,

Inc.

Read what FTB

Executive Officer Selvi Stanislaus had to say in the

Read what FTB

Executive Officer Selvi Stanislaus had to say in the

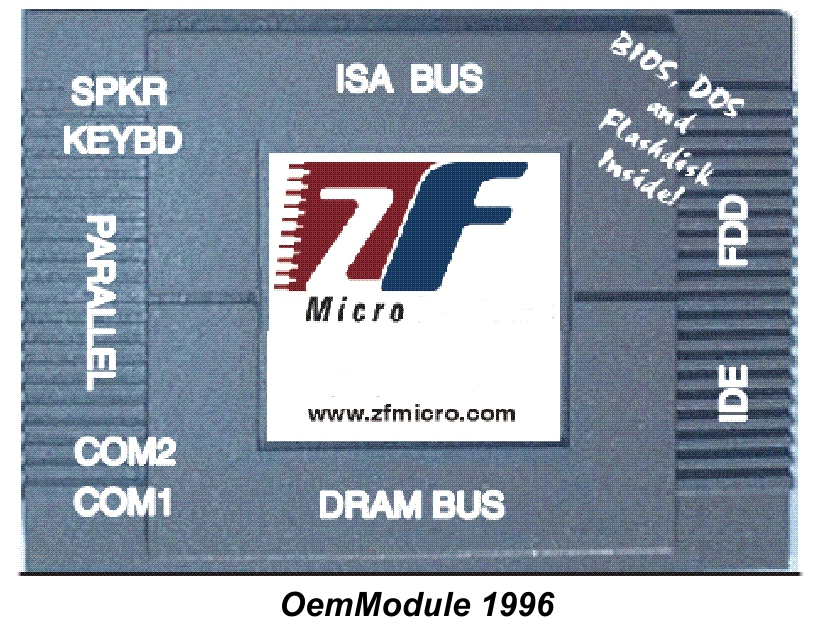

In July of 1995, I founded ZF Micro Devices, Inc., which

introduced its first product, an under 4-watt embedded PC system the

size of a credit card, in early 1996. In November of 1999, ZF Micro

Devices introduced the ZFx86 PC-on-a-Chip. It used less than 1-watt of

power, was slightly larger than a postage stamp, and was the equivalent

of a PC motherboard in a single chip. It had our patented Failsafe boot

technology that allowed it to boot and recover from all manner of

software crashes whether caused by software bugs or external attacks.

The company received investment from numerous venture capital firms as

well as international corporations like National Semiconductor

Corporation, Samsung, and others. The ZFx86 was an immediate success and

found its way into over 400 products at companies around the world.

In July of 1995, I founded ZF Micro Devices, Inc., which

introduced its first product, an under 4-watt embedded PC system the

size of a credit card, in early 1996. In November of 1999, ZF Micro

Devices introduced the ZFx86 PC-on-a-Chip. It used less than 1-watt of

power, was slightly larger than a postage stamp, and was the equivalent

of a PC motherboard in a single chip. It had our patented Failsafe boot

technology that allowed it to boot and recover from all manner of

software crashes whether caused by software bugs or external attacks.

The company received investment from numerous venture capital firms as

well as international corporations like National Semiconductor

Corporation, Samsung, and others. The ZFx86 was an immediate success and

found its way into over 400 products at companies around the world.

In 2001, one of the venture capital firms that had

invested in the company, TAT Capital Partners, Ltd. (“TAT”), a Swiss VC

firm with its main US Office in San Jose, California tried to take

control of the company by thwarting the company’s efforts to obtain the

funding needed to fill the more than $20-million of purchase orders we

had in hand (there was another $40M waiting behind that). That greed

resulted in the company running out of cash and its assets being sold at

auction. That was when I founded ZF Micro Solutions, which purchased the

rights to the ZFx86 technology.

In 2001, one of the venture capital firms that had

invested in the company, TAT Capital Partners, Ltd. (“TAT”), a Swiss VC

firm with its main US Office in San Jose, California tried to take

control of the company by thwarting the company’s efforts to obtain the

funding needed to fill the more than $20-million of purchase orders we

had in hand (there was another $40M waiting behind that). That greed

resulted in the company running out of cash and its assets being sold at

auction. That was when I founded ZF Micro Solutions, which purchased the

rights to the ZFx86 technology.